- #Does venmo charge a fee to deposit into bank for free

- #Does venmo charge a fee to deposit into bank code

- #Does venmo charge a fee to deposit into bank plus

- #Does venmo charge a fee to deposit into bank free

But if you don’t want to share your transactions, you can always change your settings.

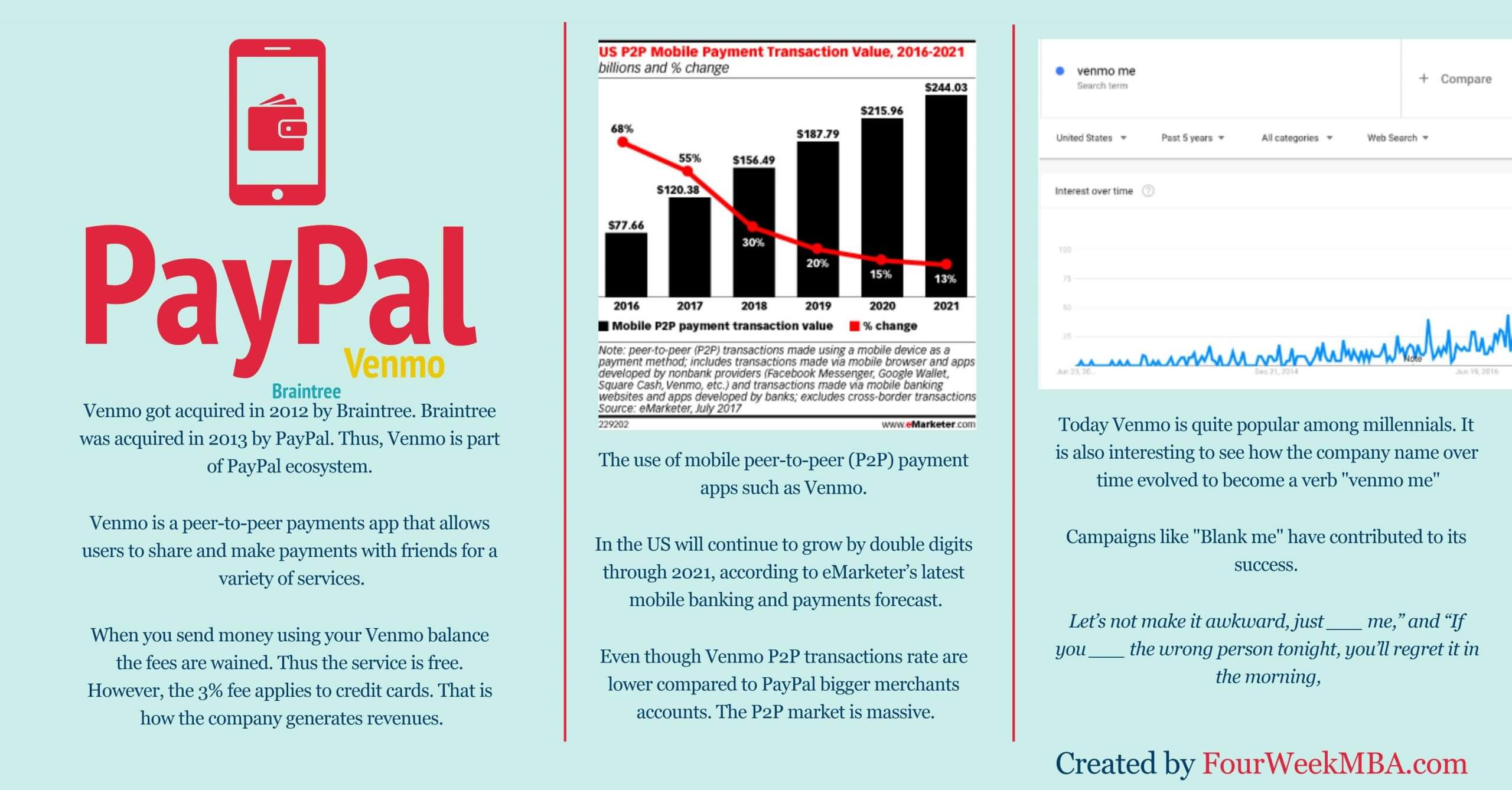

You can “add” friends and your transactions get shared via a public feed. The app also functions similarly to social media sites. Receiving money via the mobile app is always free. However, you’d face a 3% fee if you use a credit card or a different debit card.

#Does venmo charge a fee to deposit into bank free

Transferring money is free as long as you’re using your Venmo balance or a linked bank account or accepted debit card. You can link your own bank account, credit card or debit card to cover the funds. From there, you can send money using someone’s email address and phone number.

#Does venmo charge a fee to deposit into bank for free

You and your recipient just have to sign up for free accounts. Venmo is a popular online service that lets you transfer money via a mobile app. You can typically cash a check at any bank, regardless of whether you have an account. The recipient will also pay a $1.50 fee for check withdrawals. This check typically arrives in one to two weeks. The recipient simply needs to log on to PayPal and request that a check be mailed. The fee can span from 3.4% to 3.9% if you use a credit card or a non-linked debit card.īut if your recipient is in the U.S., he or she doesn’t need a bank account to receive your transfer. If you’re sending money outside the U.S., the fee can range from 0.5% to 2% if you use your PayPal balance or a linked bank account to cover the cost.

#Does venmo charge a fee to deposit into bank plus

Otherwise, you’d face a 2.9% fee per transaction plus an additional 30-cent fee. And as long as you use your PayPal balance or a linked debit card to cover transfers, the service stays free. The service also supports more than 20 currencies. However, they’d have to sign up for a free account to get their funds. With PayPal, you can send money to people in more than 190 countries using only their email addresses and phone number. When it comes to online money transferring apps, PayPal still reigns supreme. The Western Union website has a fee estimator tool you can use.

Your recipient may face a fee closer to $25 if he or she is picking the money up at an agent location. But transferring money domestically usually costs anywhere from $1 to $2.

#Does venmo charge a fee to deposit into bank code

Your recipient can simply pick up the cash or a prepaid debit card at a Western Union location near to where he or she is.įees depend on factors like the zip code where you’re sending money from as well as that of its destination.

0 kommentar(er)

0 kommentar(er)